The Serbian government in its style – therefore foggy and ambiguous but very orchestrated – announced selling of the National Oil Company (NIS) in connection with which citizens have special expectations given that it is the most valuable national resource. News was launched via a “letter of intentions” published by the Russian Gazprom with, to put it mildly, a very strange and enigmatic title: ‘The Background Document – Gazprom and Serbia.’ And this all happens in time when the Government promises (to adult citizens) a free distribution of shares of the public companies among which the greatest expectations are connected with NIS’s shares. All this, therefore, was launched in the way that ignorant, and such are unfortunately, our ordinary citizens, are not able to understand anything, except that the process of sale is now underway and that the Government of the Republic of Serbia decides about its.

THOSE A BIT MORE INFORMED COULD FORESEE AT LEAST THREE MORE IMPORTANT POINTS:

First, this is the matter of a direct agreement therefore the sale not allowing participation of the greater number of interested buyers and this all for price several times below all prices so far mentioned i.e. for Euro 400,000,000, plus investments in the amount of Euro 500,000,000 in the next five years.

Secondly, the object of sale is total property including the entire Serbian market and monopole that NIS holds on this market. This means all together – from the total production of oil and gas, refineries, more than 500 oil stations to the underground gas reservoir at Banatski Dvor and other vast property both stationary and removable.

Third, this price and the model of “selling” are conditioned by political reasons. As Minister Bubalo says, the Government takes into account the “geo-strategic” reasons. Prior to any comment, one has to understand what at this moment makes our national oil company and what its value amount to on the objective world market.

Let’s take, for sake of reference, only three comparisons. Let’s start with the book value of NIS’ property amounting to about $ 1,400,000,000 (ca Euro 950,000,000), as an independent auditorial house has repeatedly confirmed. At the first glance it is clear that the price offered is more than twice lower that is the sheer book value of the company. And we know on the basis of our experience from already finished auction and bid sales, far less attractive firms here reached-were sold for price far above their book values. What’s more, if we take the value of just one year of oil extraction on the fields of Vojvodina, which amounts to some more than 650,000 tons (about 4,000,000 barrels) at minimal expected price of $ 100 per barrel, we come to the amount of $ 400,000,000. When we add to this the gas production of about 250,000,000 cubic meters annually, it is evident that the offered price for our entire national oil company is lower than is the value of raw oil and gas pumped free of charge from Vojvodina’s fields only during one year!!!

Or, let’s make another comparison. The management of the company and the Government announced that the Company’s annual balance sheet will show the profit of RSD 9,000,000,000 i.e. about Euro 112,500,000.

This means that the offered price for our whole national oil company is at the level lower than is its four-year expected profit???

On the other side, in contrast to these arguments, on other pan of the scale are foggily expressed political and geo-strategic reasons. Even those informed can list nothing more than passing a “branch” of gas pipeline South Pipeline through Serbia and the political friendship with Russia. As regards gas pipeline, what is offered is just a “branch” with the maximum range to Bosnia and Herzegovina, while the main gas pipeline passes through Bulgaria. All potential “benefits” from this passing “branch” cannot compensate this low offered price for the whole Company.

As regards Russian friendship it has never been, at least when we speak about prices of energy commodities which we import from them, clearly confirmed, because we have been paying the same or even higher price than other European countries. For instance, Germany pays gas up to 20 percent less than we pay for it because it orders larger qualities and pays more regular than we do. Therefore, with our Russians friends there is in effect for quite a time the rule that we are brothers, but our “purses” are not sisters.

Finally, if we even abandon all aforementioned, there remains a question for Minister Dinkić and the Government whose member he is. Does the promise of about Euro 1,000 value of free shares per head of adult citizen of our country from the sale of public companies equal to “fools rejoice at promises”? Because, even economic amateurs are aware that thus promised value of free shares and thus offered price for NIS cannot go together …

Text was published in the Danas Daily on January 21st, 2008.

The author was the President of the NIS Managing Board from 2002 to 2004.

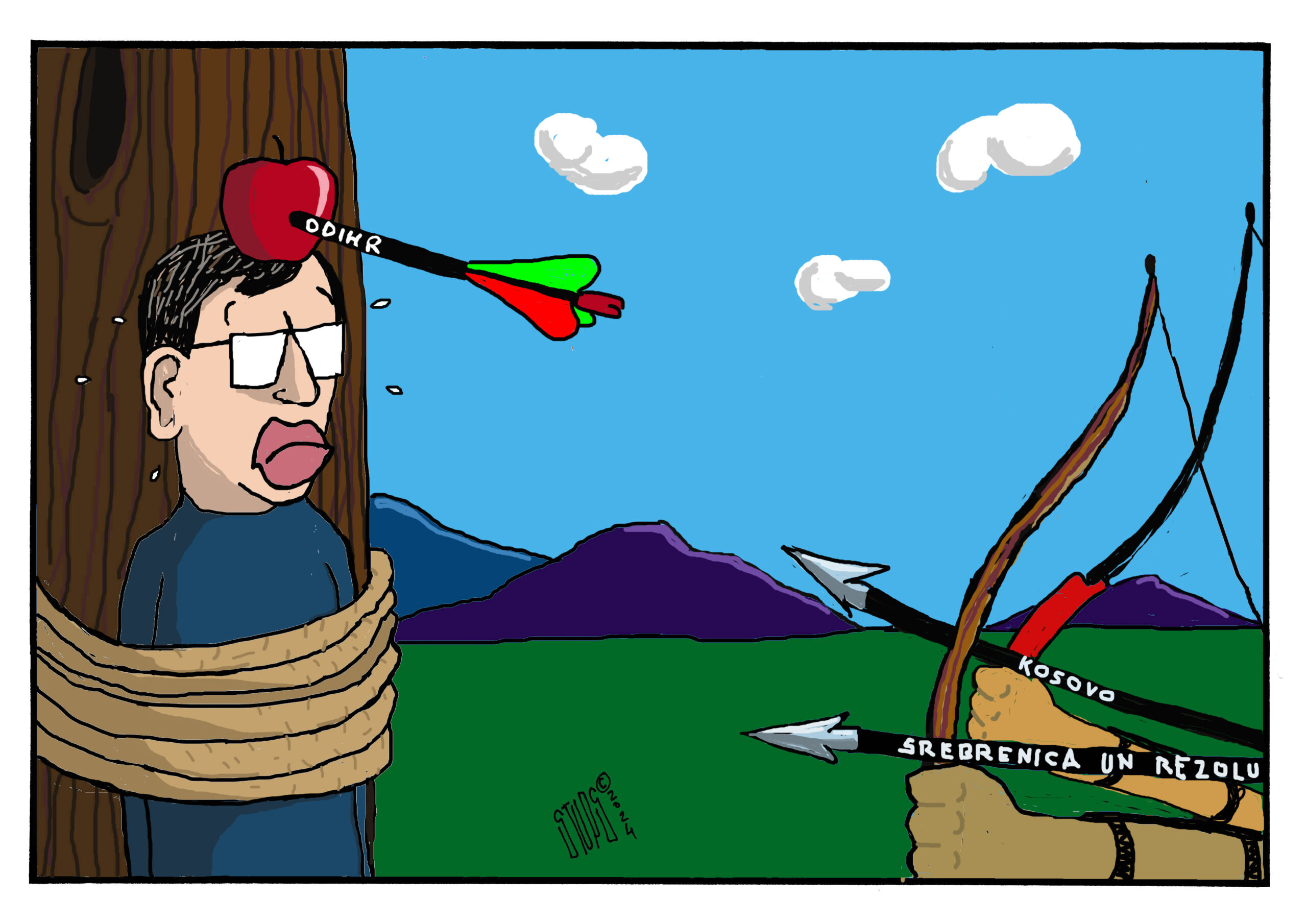

STUPS: Diplomatija

STUPS: Diplomatija