Due diligence can be described as vital a part of any business transaction. That ensures that all parties involved in a deal understand the worth and significance of a purchase, and helps prevent any potential problems down the road. The problem is that traditional due diligence processes often involve sharing physical documents with multiple interested parties at once, which can be hard, time consuming and risky.

A virtual data room designed for due diligence can easily solve this issue by providing a secure online platform just for document showing. This helps you to save valuable moment for everyone involved in a deal, especially investors who need to access facts quickly to have a decision about investing. It also eradicates the need to give files by using email, which are often dangerous if the file contains sensitive information.

When choosing a electronic data bedroom for due diligence, look for you with user-friendly interfaces which might be compatible with almost all important devices and operating systems. It will support drag-and-drop uploads, single-sign on, auto index numbering, and easy document arrangement and navigation. It may also be attainable to users from across the world, which is essential if your www.mousam-river.com/business/datarooms-are-used-in-a-variety-of-ways-by-deal-teams/ team entails professionals of various nationalities.

Some virtual info rooms even have a ready-made investment due diligence checklist you can use to determine what documents to upload for a specific purchase. They can be personalized to fit a company’s certain needs, and supply advanced activity credit reporting that provides regarding how effort is certainly progressing.

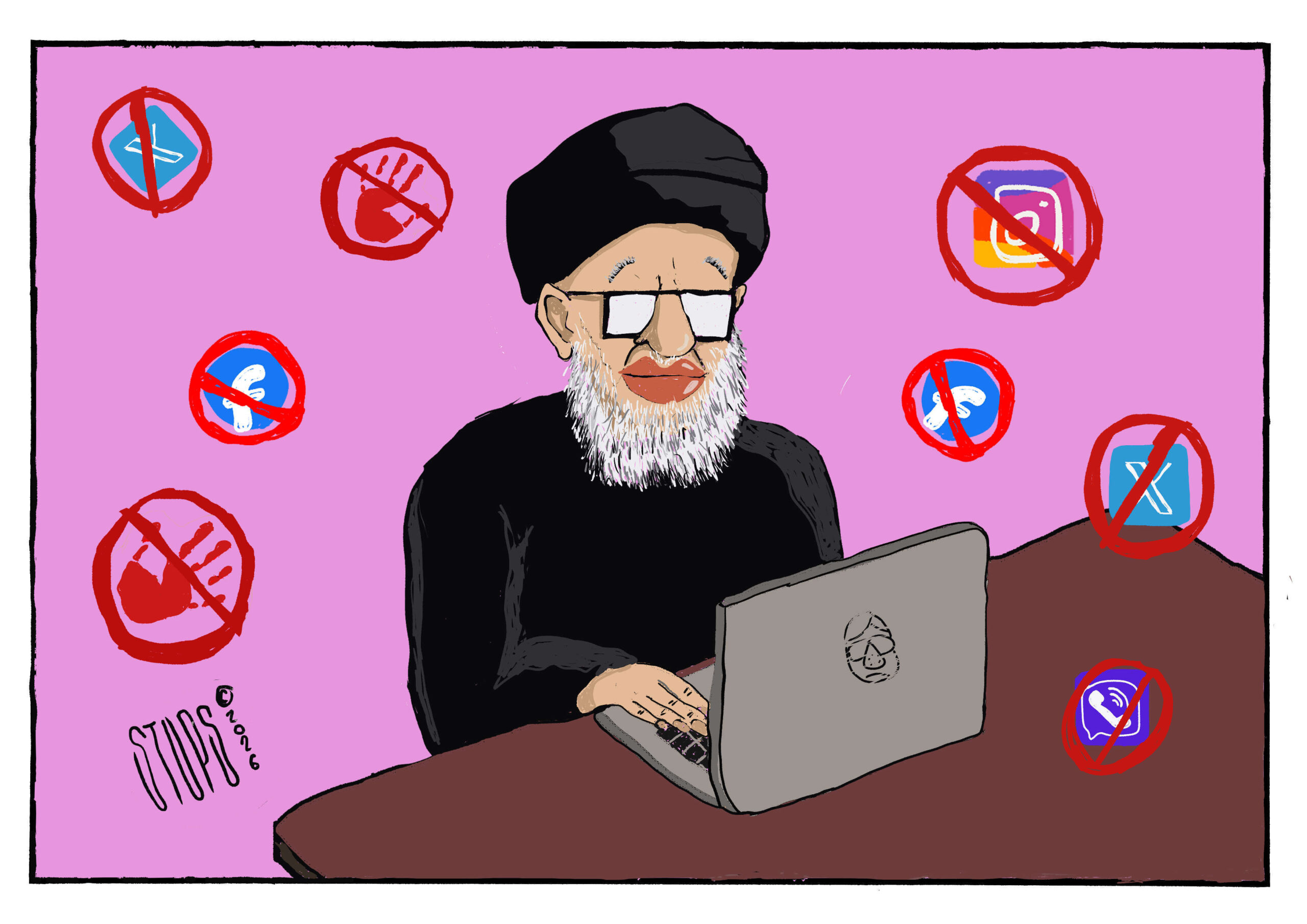

STUPS: Internet ratnik

STUPS: Internet ratnik